Help Me Decide

Are you thinking about starting a small business retirement plan? Perhaps your existing plan needs some help. Let’s consider some of the best IRS-qualified retirement plans:

- 401(k) plan

- 401(k) plan with Profit Sharing

- Cash Balance plan

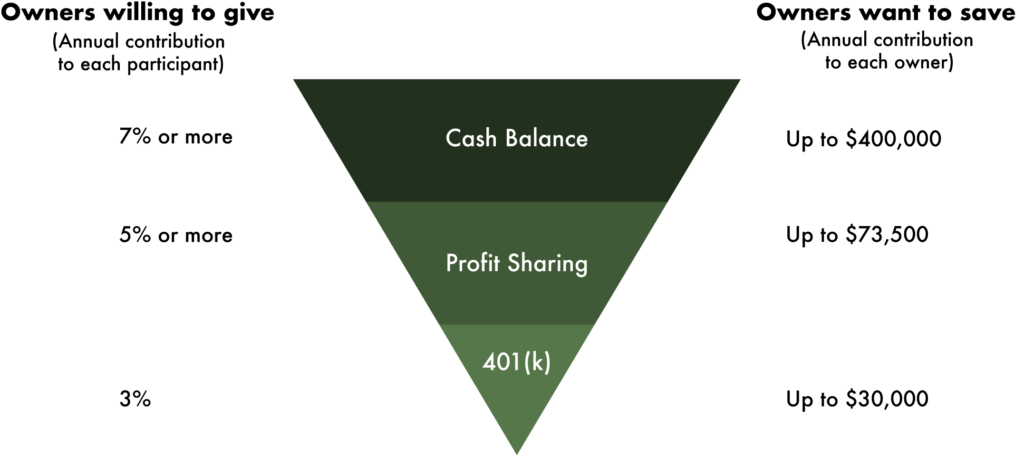

Owners can contribute increasingly larger amounts to their personal retirement account when they use profit sharing and Cash Balance plans. These increased contributions also increase their tax savings. To qualify for larger personal contributions, owners must also contribute to employee retirement accounts.

The primary factor in choosing the right plan is often how much money owners want to contribute to their personal accounts each year. The more that owners want to save, the larger contribution they’ll need to provide to employees to pass nondiscrimination testing.

We recommend you consider a 401(k) plan. You should anticipate contributing approximately 3% of employee income.

A 401(k) plan with Profit Sharing will likely work for you. You should anticipate contributing approximately 5% of employee income.

A Cash Balance plan combined with a 401(k) with Profit Sharing will likely work for you. You should anticipate contributing approximately 7% of employee income.